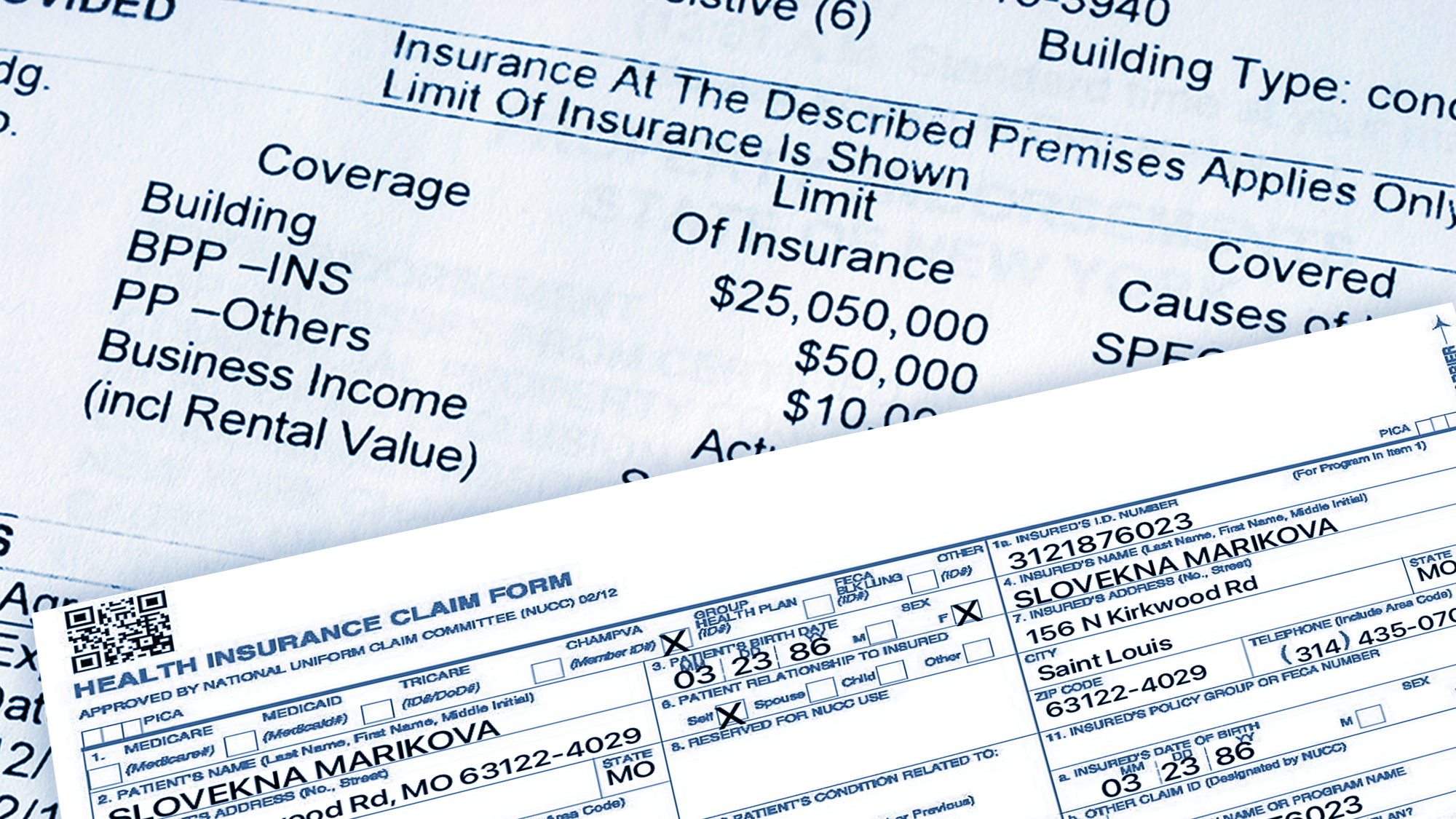

Securing Sensitive Data in Insurance

In the insurance sector, the protection of sensitive data is the prime subject. From client records to claims information, ensuring the confidentiality and integrity of data is critical for regulatory compliance and maintaining customer trust. This article explores how TransferChain's secure data platform addresses key challenges related to sensitive data transfers, requests from external services, storing sensitive data, and the looming risk of data leaks within the insurance industry.

Use Case 1: Secure Data Transfers

Scenario: An insurance company needs to securely transfer sensitive client information to its reinsurance partner located overseas.

Solution: TransferChain's secure data platform employs end-to-end encryption and secure file transfer protocols to safeguard data during transit. This ensures that sensitive information remains protected from interception or unauthorized access, even when traversing external networks.

Use Case 2: Secure File Requests

Scenario: An insurance company needs to request sensitive client documents, such as medical records or financial statements, from its clients for policy assessments and claims processing.

Solution: TransferChain's secure data platform provides a secure file request feature that allows insurance companies to request sensitive documents from clients. Using end-to-end encryption and secure request protocols, TransferChain ensures that the requested documents are transmitted securely. This protects sensitive information from interception or unauthorized access during the request and submission process, maintaining client confidentiality and compliance with data protection regulations.

Use Case 3: Secure Storage of Sensitive Data

Scenario: An insurance company stores vast amounts of sensitive client data, including personal information and medical records, in its databases.

Solution: TransferChain's secure data platform offers scalable and redundant storage options with advanced encryption and access controls. Immutable records stored in a multi-cloud structure that runs on a blockchain ledger ensure a tamper-proof process, reducing the risk of data manipulation or leakage.

Use Case 4: Secure Password Management

Scenario: An insurance company needs to manage and store numerous passwords for various systems, databases, and client accounts securely, ensuring that only authorized personnel have access.

Solution: TransferChain Pass secure data platform includes a robust password manager that employs end-to-end encryption and secure storage protocols. This ensures that passwords are stored securely and are only accessible to authorized personnel. The secure password-sharing feature also helps teams within the organization manage their accounts securely and proactively. TransferChain helps the insurance company maintain the highest level of security for its sensitive access credentials, protecting against unauthorized access and potential breaches.

Use Case 4: Mitigating the Risk of Data Leaks

Scenario: An insurance company faces the constant threat of data leaks, which could lead to reputational damage and regulatory penalties.

Solution: TransferChain's secure data platform incorporates advanced security measures such as end-to-end encryption, split files, and blockchain integration This allows insurers to avoid any potential security incidents promptly, minimizing the impact of data breaches and mitigating associated risks.

Use Case 5: Integrating External Services

Scenario: An insurance firm integrates a third-party claims processing service into its operations, requiring access to sensitive customer data.

Solution: TransferChain's secure data platform facilitates secure integration with external services through SDKs. This allows controlled access to sensitive data while mitigating the risk of data exposure or unauthorized usage by external parties.

Conclusion:

In an increasingly digital world, the insurance sector must prioritize the security of sensitive data to safeguard customer trust and comply with regulatory requirements. TransferChain's secure data platform provides tailored solutions to address the challenges of sensitive data transfers, requests from external services, storing sensitive data, and mitigating the risk of data leaks within the insurance industry.

By leveraging advanced encryption, secure communication protocols, blockchain, multi-cloud, and robust security features, TransferChain empowers insurers to protect their most valuable assets and uphold the highest standards of data security and compliance.